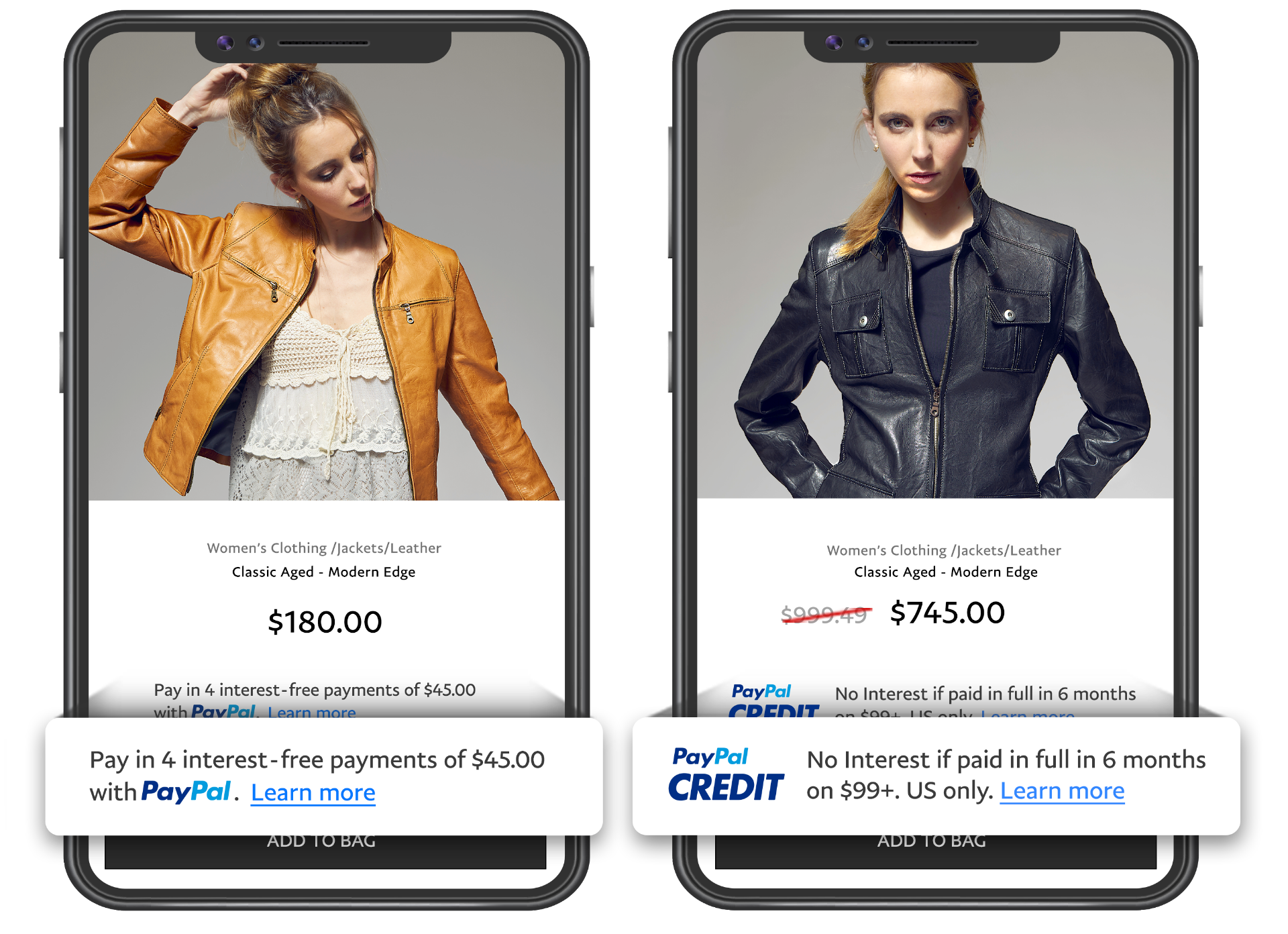

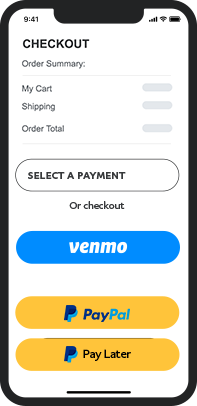

Help increase sales by offering Pay Later options to your customers. Pay Later allows customers to pay over time while you get paid up front—at no additional cost to your business. Businesses with pay-over-time messaging on their site have seen their overall PayPal average order value increase by up to 56%.5

Easton Digital

The Company

Easton Digital is a marketing agency specializing in helping small and midsize ecommerce store owners grow their sales and profits with Google Shopping. Its proprietary marketing software combines human-powered product and campaign strategies with Al-driven campaign optimizations to provide product, website : marketing recommendations that help its clients' brands grow.

The Challenge

Easton Digital works with a well-known sunglasses company offering classically styled shades in a wide range of colors with a price point starting at just $10. While the brand was very successful via social media and email marketing campaigns, when they raised bids to obtain higher ad positions and increase ad traffic, their profit margin significantly dropped. Potential customers were clicking its ads but quickly leaving the brand's website without purchasing. The problem was that the brand's ads were using search terms unrelated to its products, causing them to waste 66% of ad spend on generic, unprofitable traffic.

The Solutions

Easton Digital used a combination of Cart Channel's merge file option and rule-based modifiers to add relative keywords to its client's product titles and descriptions. Then, they automatically identified and segmented best-selling, new and seasonal products, allowing them to focus campaign efforts on the brand's most profitable items. Plus, Easton Digital used Cart. com's campaign priority settings and negative keywords to create campaigns for branded, profitable and generic search terms.

The Result

Easton Digital increased its client's click- through rate (CTR) and ad relevance on non- branded, high-volume terms, which increased its ad positions and traffic. They continuously adjusted titles and tested new keywords and products, making additional adjustments based on holidays and seasonality.